In the world of trading and investment, visualizing data through various charting methods is essential. Different charting styles provide unique perspectives on price movements, trends, and volatility. This comprehensive guide explores various chart and bar styles, including Line Charts, Bar Charts, Range Bar Charts, Heikin Ashi Charts, Renko Charts, Kagi Charts, and Point & Figure Charts. Understanding these charts can enhance trading decisions and provide insights into market behavior.

Line Charts

Understanding Line Charts

A line chart is one of the simplest forms of charting, connecting closing prices over a specific period. It provides a clear visualization of the overall trend direction.

Bar Charts

Understanding Bar Charts

A bar chart is a collection of price bars, with each bar representing price movements for a given period. It consists of vertical lines that show the highest and lowest price reached during the period. The opening price is marked by a small horizontal line on the left, and the closing price is marked on the right.

Interpreting Bar Charts

Bar charts allow traders to analyze trends, spot potential trend reversals, and monitor volatility. The length of the vertical bars indicates the price difference between the high and low of the period, reflecting volatility. A large distance between the open and close signifies a significant price move.

Bar Charts vs. Candlestick Charts

Bar charts are similar to Japanese candlestick charts, but they represent information differently. While both show the same data, the visual look varies. Candlesticks have a thicker portion called a "real body" to represent the difference between the open and close, whereas bar charts use horizontal lines.

Candlestick Chart Illustration:

Candlestick Componens Illustration:

Range Bar Charts

What are Range Bars?

Developed by Brazilian trader Vicente Nicolellis in the mid-1990s, Range Bars consider only price, eliminating time from the equation. They are different from time-based charts, as each new bar is based on price movement rather than units of time.

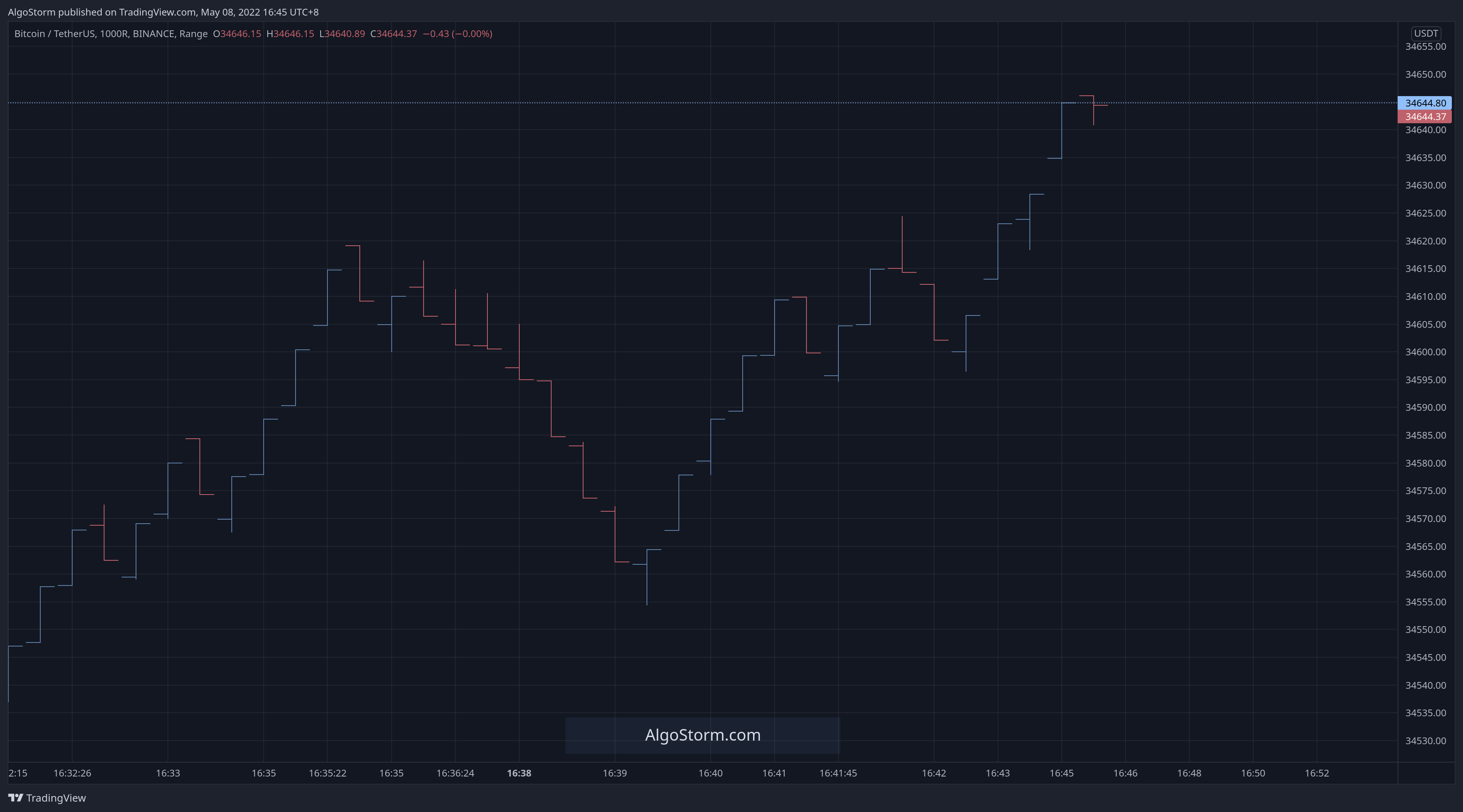

Range Bars Chart Illustration:

Calculating Range Bars

Nicolellis found that bars based on price alone provided a new way of viewing and utilizing volatility. Unlike time-based charts, Range Bar charts can have any number of bars printing during a trading session, depending on volatility and the specified price movement for each Range Bar.

Trading with Range Bars

Range Bars help traders view price in a consolidated form, reducing noise and emphasizing areas of support and resistance. They are useful for identifying trends and interpreting volatility.

Heikin Ashi Charts

What is Heikin Ashi?

The Heikin-Ashi technique averages price data to create a Japanese candlestick chart that filters out market noise. It uses a modified formula based on two-period averages, giving the chart a smoother appearance.

How to Calculate Heikin-Ashi

The Heikin-Ashi calculation involves averaging the open, close, high, and low of the actual candle with specific formulas.

What Does Heikin-Ashi Tell You?

Heikin-Ashi charts help identify trends more easily. Hollow white or green candles signal a strong uptrend, while filled black or red candles identify a strong downtrend. The technique reduces false trading signals in sideways and choppy markets.

Limitations of the Heikin-Ashi Technique

Heikin-Ashi charts may not be responsive enough for day traders who need to exploit quick price moves. The averaged data also obscures important price information, such as daily closing prices.

Renko Charts

What is a Renko Chart?

A Renko chart is built using price movement rather than both price and standardized time intervals. It looks like a series of bricks, with each block positioned at a 45-degree angle up or down to the prior brick.

What Does a Renko Chart Tell You?

Renko charts filter out minor price movements, making it easier to focus on important trends. They are effective in identifying support and resistance levels and keeping traders in strong trends.

Limitations of Using Renko Charts

Renko charts don’t show as much detail as other charts, and the use of only closing prices leaves out a lot of price data. When a reversal occurs, it can significantly erase profits or result in big losses.

Kagi Charts

What are Kagi Charts?

Kagi charts use a series of vertical lines to illustrate general levels of supply and demand. Thick lines represent an increase in demand, while thin lines represent increased supply.

What Does a Kagi Chart Tell You?

Kagi charts provide entry signals when the vertical line changes from thin to thick. They have the advantage of reducing noise and making trends more apparent.

Limitations of Using Kagi Charts

Kagi charts are sensitive to their settings, and poor settings can make them as noisy as other charting methods. Identifying trends may be harder with Kagi charts due to the constant changes in line thickness and direction.

Point & Figure Charts

What are Point-and-Figure (P&F) Charts?

P&F charts plot price movements without considering time. They utilize columns consisting of stacked X’s or O’s, representing rising or falling prices.

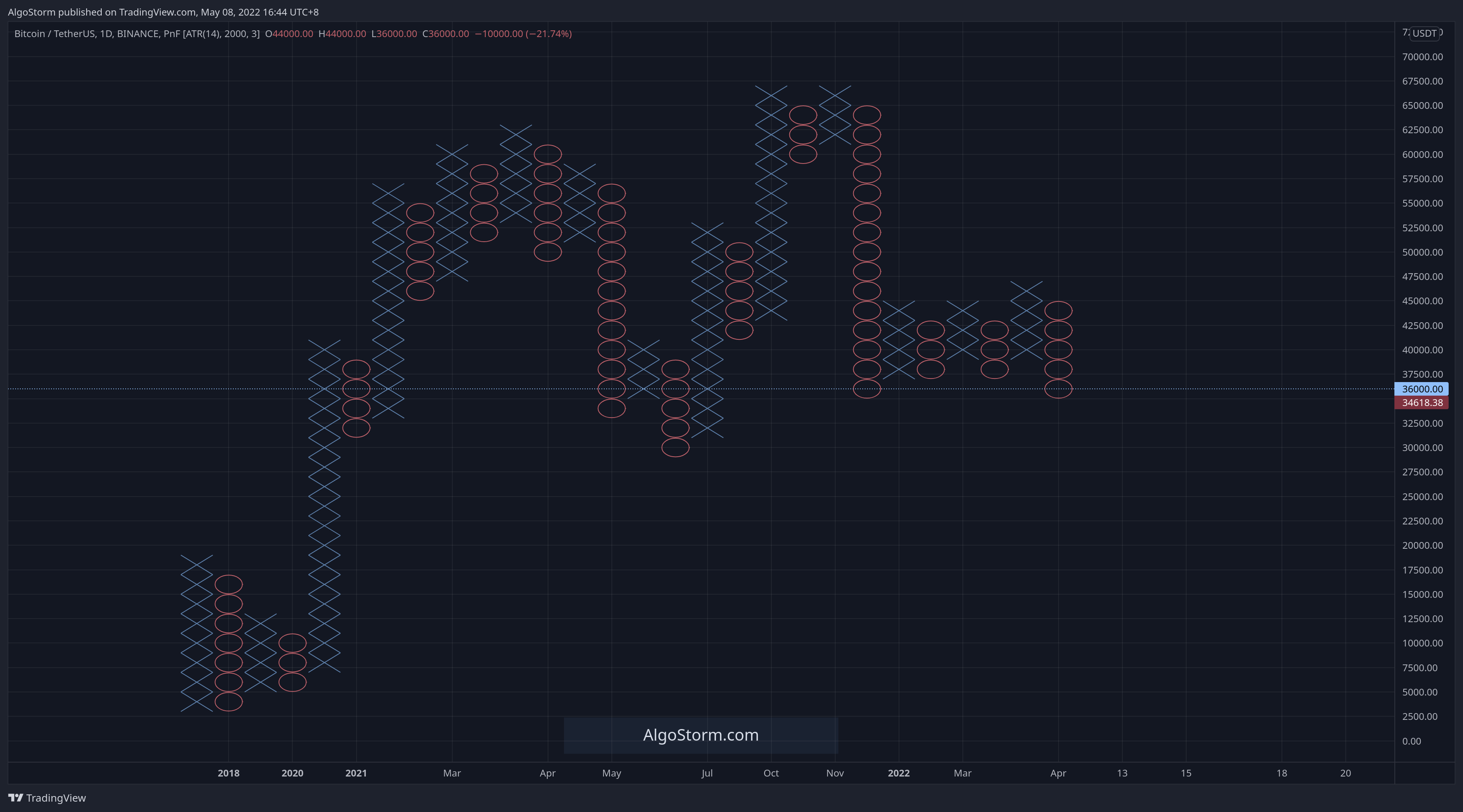

Point & Figure Chart Illustration:

How to Calculate Point-and-Figure (P&F) Charts

P&F charts require setting variables like the box size and reversal amount. The box size can be a specific dollar amount, percentage, or based on average true range (ATR).

What Does a Point-and-Figure (P&F) Chart Tell You?

P&F charts provide different trade and trend signals, often providing clearer support and resistance levels and breakouts.

Limitations of Using Point-and-Figure (P&F) Charts

P&F charts can be slow to react to price changes, and false breakouts still occur. They may also filter out too much information, leading to delayed signals.

Choosing the Right Bar Style

Choosing the right style depends on the trader’s strategy and preferences. There is no right or wrong style, but it’s vital to learn how to read any type of chart, regardless of the bar style chosen. Many traders prefer Japanese candlestick charts for their popularity and ease of interpretation.

Conclusion

Charts and bar styles are essential tools for traders and investors. Understanding various charting methods helps in making informed trading decisions, recognizing trends, and interpreting market behavior. By selecting the appropriate chart style, traders can enhance their ability to analyze and respond to market dynamics.