Introduction to the Dow Theory

The Dow Theory is a cornerstone of technical analysis, derived from the writings and observations of Charles Dow, a pioneering figure in market theory. As the founder and editor of the Wall Street Journal and the co-founder of Dow Jones & Company, Dow’s insights have shaped modern investment strategies.

Though Dow never formalized his ideas into a specific theory, his editorials in the Wall Street Journal laid the groundwork for what would later become known as the Dow Theory. After his death, followers like William Hamilton expanded and refined these ideas, creating a framework that continues to influence traders and investors today.

This article delves into the Dow Theory, exploring its principles, applications, and limitations.

The Core Principles of Dow Theory

1. The Market Reflects Everything

Dow’s belief that the market discounts everything is akin to the Efficient Market Hypothesis (EMH). According to this principle, all available information, including future expectations, is already reflected in the price of an asset.

Example:

If a company is anticipated to report positive earnings, the market will factor this in before the report’s release. Consequently, the price may not change significantly after the expected positive report is announced.

This principle is embraced by many technical analysts but contested by fundamental analysts who argue that market value may not always represent the intrinsic value of a stock.

2. Market Trends

Dow’s work laid the foundation for the concept of a market trend, categorizing trends into three main types:

- Primary trend: The overarching market movement, lasting from months to years.

- Secondary trend: Shorter-term fluctuations, lasting from weeks to a few months.

- Tertiary trend: Brief trends, often lasting less than a week.

Understanding these trends allows investors to identify opportunities, especially when secondary and tertiary trends seem to contradict the primary one.

Example:

A positive primary trend in a cryptocurrency may be temporarily offset by a negative secondary trend, creating a buying opportunity.

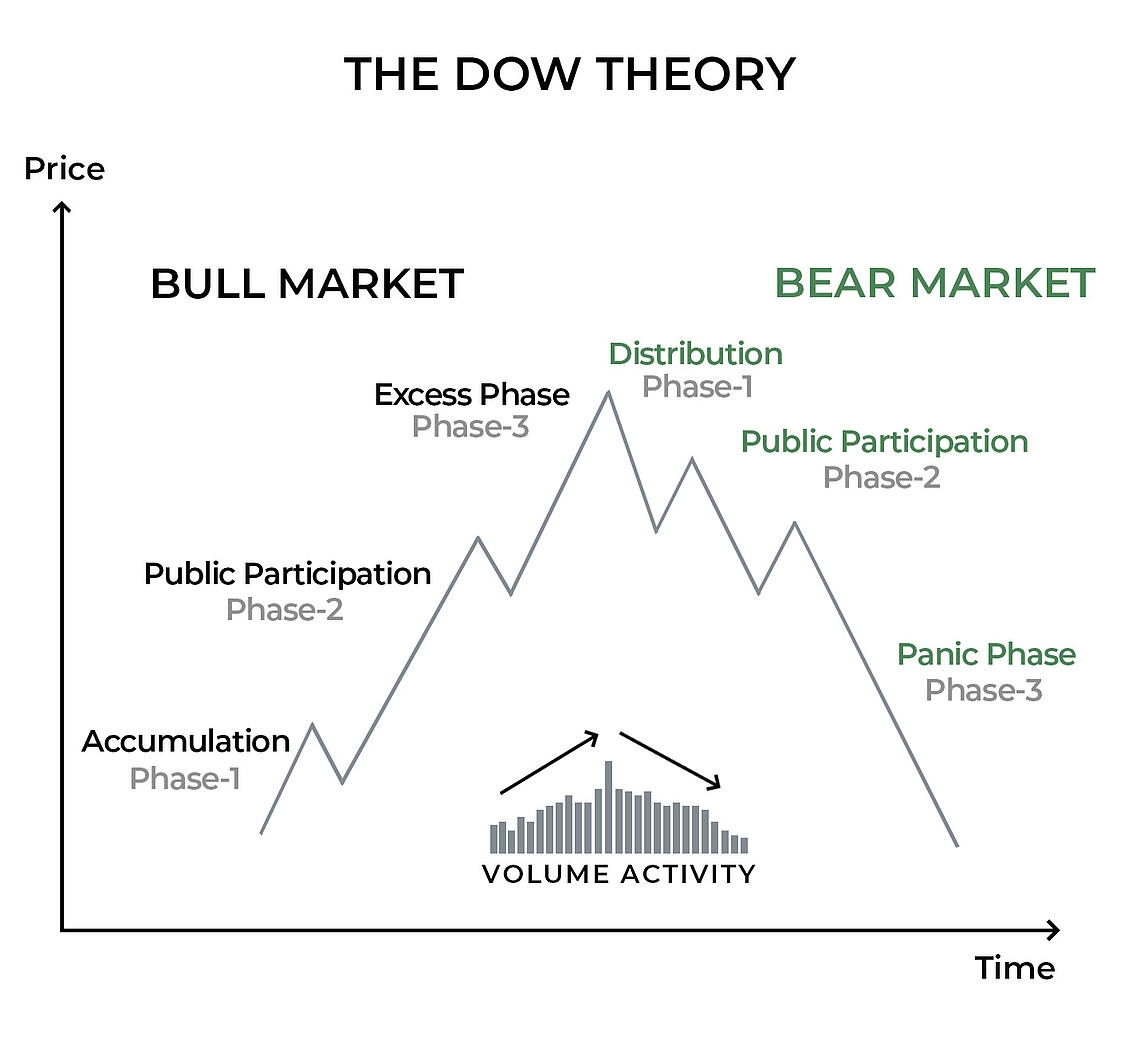

3. The Three Phases of Primary Trends

Dow identified three phases in a long-term primary trend:

- Accumulation: Smart traders begin to buy, recognizing undervalued assets.

- Public Participation: Wider market participation drives rapid price increases.

- Excess & Distribution: Market makers sell off holdings as the trend nears its end.

These phases are reversed in a bear market, starting with distribution and ending with accumulation.

4. Cross-Index Correlation

Dow emphasized the correlation between different market indices, such as the Dow Jones Transportation Index and Dow Jones Industrial Average. This principle has evolved over time, reflecting changes in the global economy, but still offers insights into market dynamics.

5. Volume Matters

Dow considered volume a vital secondary indicator, with higher trading volumes reinforcing the validity of a trend. This principle remains a fundamental aspect of modern technical analysis.

6. Trends Are Valid Until A Reversal Is Confirmed

According to Dow, a trend will persist until a definitive reversal occurs. This belief underscores the importance of distinguishing between temporary fluctuations and genuine trend reversals.

Applications and Limitations of Dow Theory

Applications

The Dow Theory’s principles are widely used in various investment strategies, including the Wyckoff Method, which also focuses on accumulation and distribution phases.

Limitations

While influential, the Dow Theory has limitations:

- Interpretation Challenges: Identifying trends and reversals requires skill and experience, and misinterpretations can lead to investment errors.

- Changing Market Dynamics: Some principles, such as cross-index correlation, may not apply as strongly in today’s digital economy.

- Not Infallible: Like any theory, the Dow Theory is not foolproof and should be used in conjunction with other analytical tools and market insights.

Conclusion

The Dow Theory remains a foundational concept in technical analysis, offering valuable insights into market trends, volume analysis, and investor behavior. Its principles continue to guide traders and investors, helping them navigate complex market landscapes.

However, the Dow Theory is not a one-size-fits-all solution. Successful application requires a nuanced understanding of its principles, adaptability to changing market conditions, and integration with other analytical methods.

By appreciating both the strengths and limitations of the Dow Theory, investors can make more informed decisions, capitalizing on opportunities while mitigating risks. As with all investment strategies, continuous learning, critical thinking, and prudent risk management are essential for long-term success.